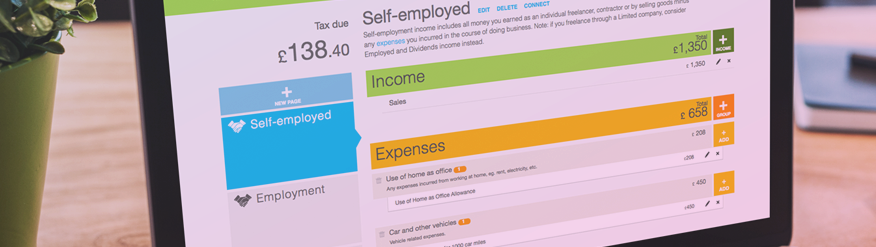

Coronavirus (Covid-19) – claiming home-working expenses Normally claims for tax relief for unreimbursed home-working expenses

What home office expenses can I claim as a limited company director? - West Lancs Chartered Accountants

Karen Vecchio, Elgin-Middlesex-London - Working from home? Here's info on how to claim expenses for your 2020 tax return - Canada Revenue Agency (CRA) has made the home office expenses deduction available

Tax return Australia: what expenses can I claim if I've returned to the office for work? | Life and style | The Guardian

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)