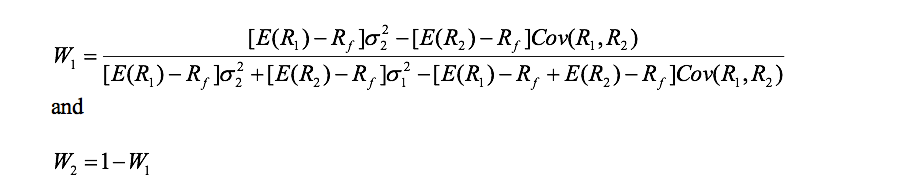

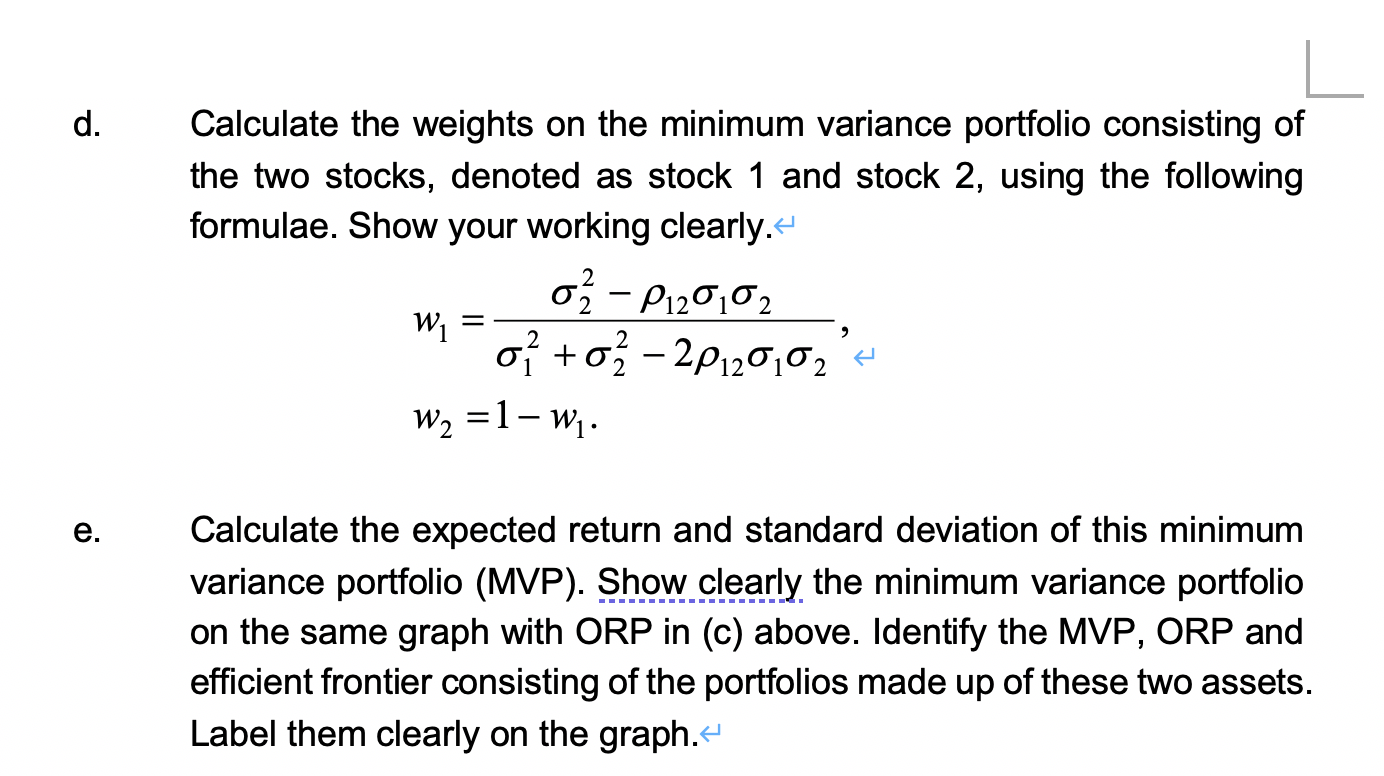

optimization - Formula for Optimal Portfolio of 2 Assets when No Shorting Allowed? - Quantitative Finance Stack Exchange

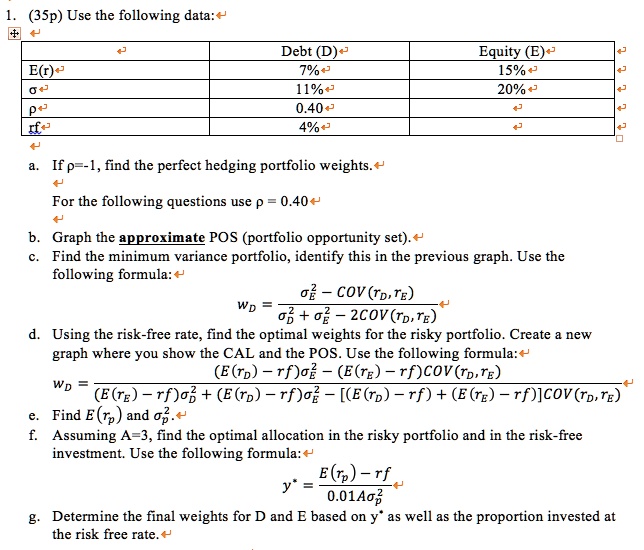

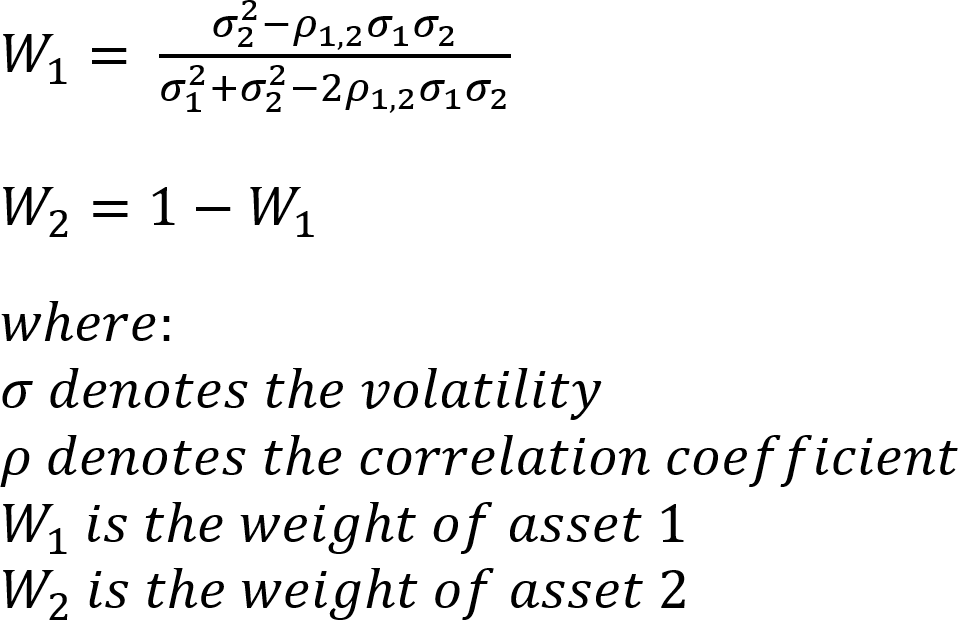

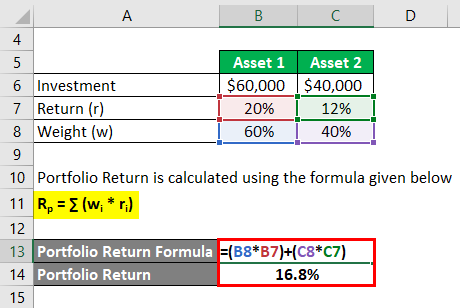

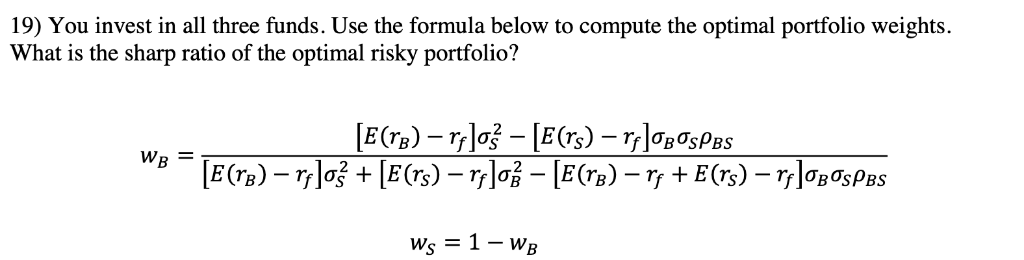

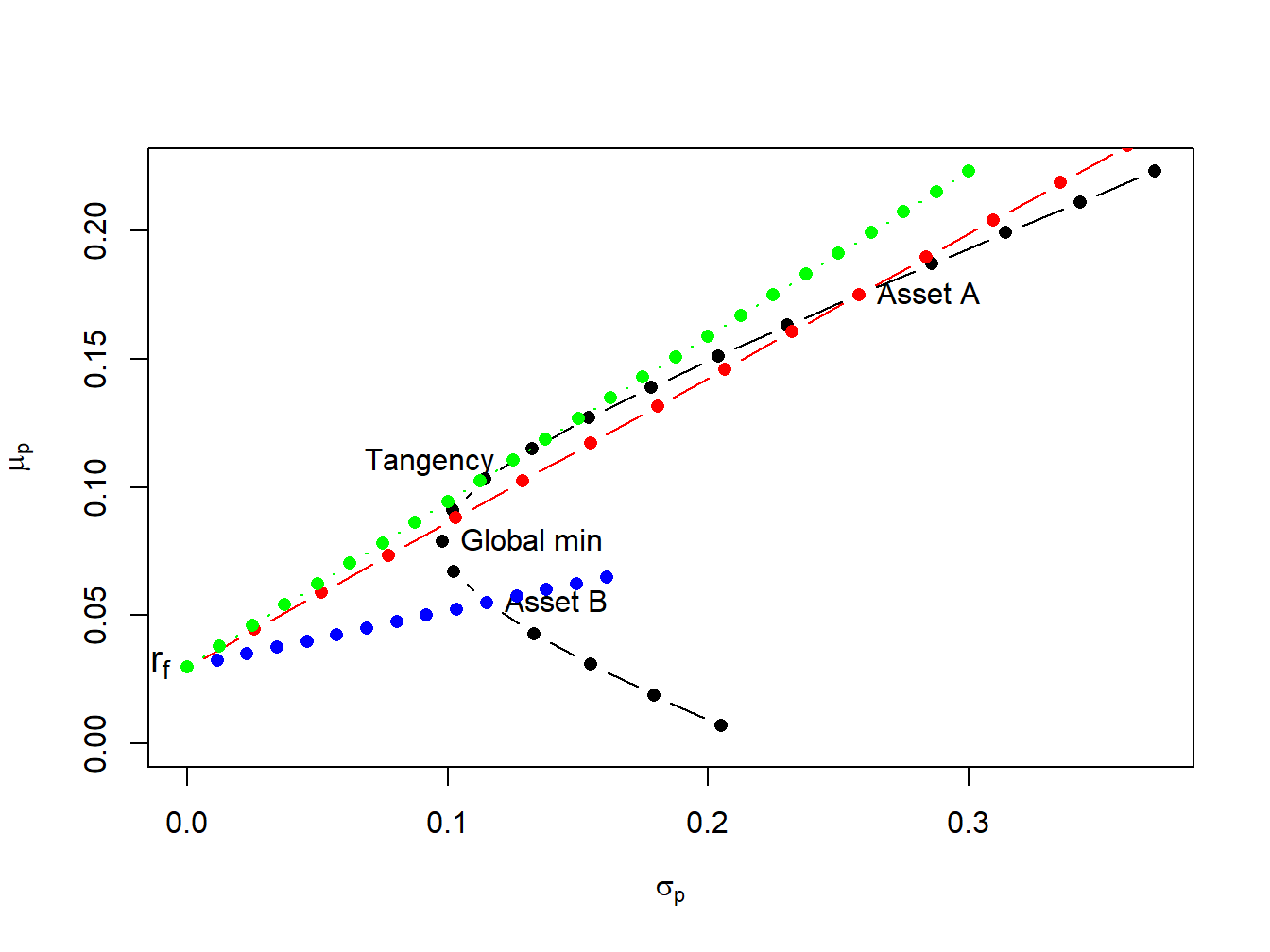

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R